iPhone holds most of its value and market share to 2018

As sales growth slows and prices fall, Apple is expected to keep skimming the cream.

FORTUNE -- The heyday of smartphone sales is over, according to an IDC reportissued this week.

The U.S.-based market research firm expects growth in worldwide smartphone shipments, which approached 40% last year, to slow to less than 20% in 2014 and then within a few years to shrink to single digits: 8.3% in 2017 and 6.2% in 2018.

For a company like Apple (AAPL), which depends on smartphone sales for more than half of its revenue and whose share of shipments has fallen below 15%, that's bad news, right?

Not necessarily.

Although IDC predicts that smartphone growth over the next four years will mostly be in price-conscious developing markets, and that sales growth in Apple's strongholds -- the U.S. and Europe -- has already slowed to single digits, there is a silver lining for Apple.

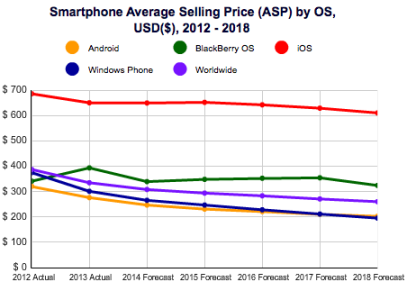

It's represented by the red line in the attached IDC graphic.

Apple's competitors, IDC reports, are moving down the price curve to reach all that untapped demand in emerging markets. From IDC's press release:

"The result is rapidly declining price points creating challenging environments in which to turn a profit. Worldwide smartphone average selling price (ASP) was $335 in 2013, and is expected to drop to $260 by 2018... We've already seen numerous smartphone announcements targeting [the under $150] priceband this year, with some as low as $25."

"Not all vendors," it adds, "will want to get into this space."

That would probably be Apple. Last year, according to Raymond James' Tavis McCourt, it took home 87.4% of mobile phone profits. Why mess with that?

Below: IDC's spreadsheets.

Comments

Post a Comment